There are two credit reporting agencies in Canada that provides credit scores – Equifax and TransUnion. Your credit or (Fico) score is made up of three-digit number that is calculated based on the information on your credit report. The number range from 300-900 and is used by risk managers (mortgage lenders, Sunlite Mortgage agents, auto dealers, property managers, employers etc.) to assess the risk of a borrower( purchase and mortgage refinance , renters, or potential employee prior to either lending, renting, or hiring to name a few. You can get a free Equifax or TransUnion credit report by contacting the respective credit reporting agencies. This report is for your information only and cannot be used by any of the entities listed above to assess your risk as a borrower.

Your credit score is one of several pieces of information that is used to determine your creditworthiness. Sometimes the score does not tell the entire story as consumers with good but short payment histories may be considered low risk for continuing payments with the credit that they already have, however may be considered high risk if they were granted new credit. They may be able to handle payments on their existing accounts but introducing a new credit like a large mortgage payment would require new payments, and these consumers have yet to provide proof of their ability to handle these additional responsibilities.

How are credit scores calculated and what are the factors that contribute to your Fico Score?

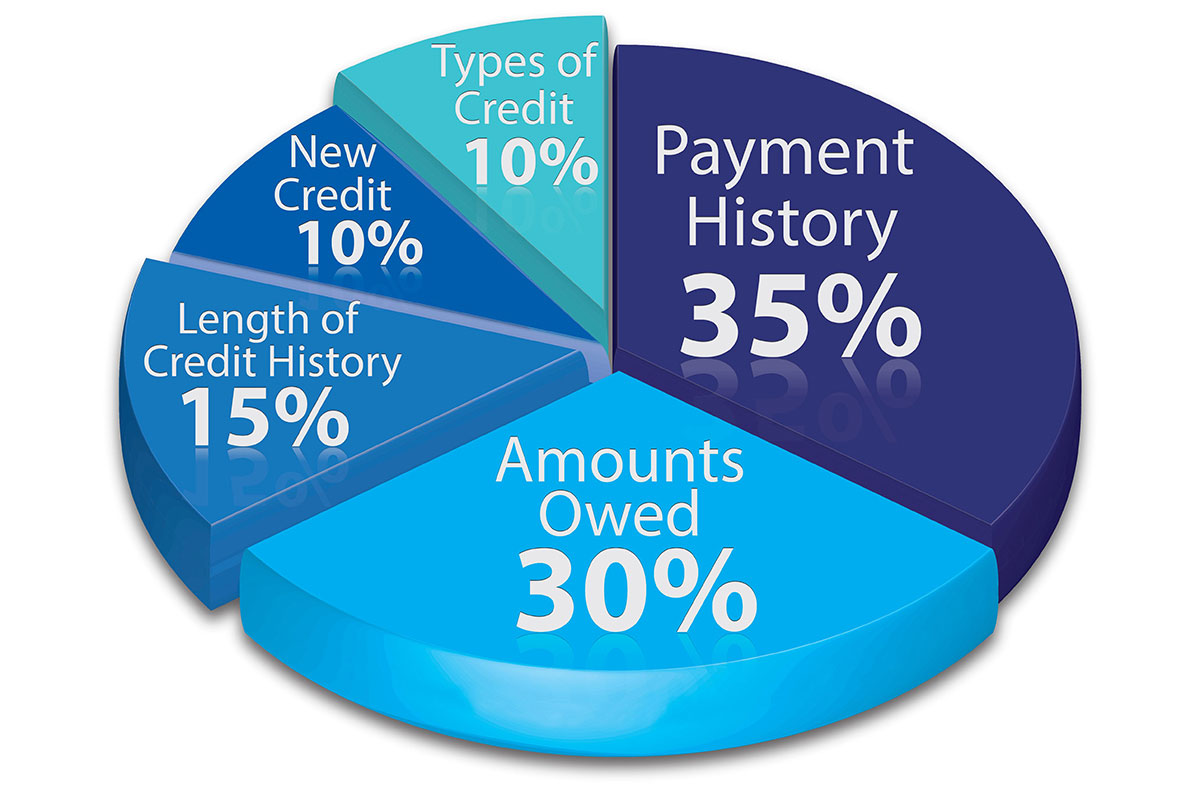

The main factors involved in calculating a credit score are:

Since the credit score is a predictor of how you will pay in the future, your historical payments of credit cards, lines of credit, retail department store accounts, installment loans, auto loans, student loans, finance company accounts, home equity loans and mortgage loans for primary, secondary, vacation and investment properties provides the best indicator of your capacity and willingness to pay in the future as information like how many of your credit accounts are delinquent in relation to all of your accounts on file. For example, if you have 10 credit accounts (known as “tradelines” in the credit industry), and you’ve had a late payment in 5 of those accounts, that ratio may impact your credit score.

Most mortgage lenders will not advance funds if you are behind in any of your payments.

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. Revolving credit like credit cards, revolving lines of credit allows you to borrow, repay, and then reuse the credit line up to its available limit. If you are anticipating getting more credit, monitoring your existing credit is very important, as the lower your monthly reported balance by your lender, the higher your score, and the more likely you will be granted credit. Anything monthly reporting above 75% of the limit will start reducing your credit score. At 90% of the limit, it starts affecting the score severely and anything over 100% of the limit will greatly affect your score.

New loans are front end loaded with interest, so if you your new load is $10,000.00 and the interest on the loan is $2,000.00 then your utilization is 120% and that will reduce your credit score. It’s a great idea not to accept more that one new loan at a time. A mortgage will have the same effect, as $500,000.00 registered on your credit bureau (if your lender reports it), will be at it’s limit and could reduce your credit score.

Lenders may not offer new credit if there are too many existing credits close to or above your limits as you may fall below their internal lending matrix.

Risk managers like to see a mature credit file – a credit file that has been open for over six years with a good repayment history and utilization that is consistently below 75% of the limit. If your current balances aren’t over 90% today, they have tools that will alert them to your repayment history for up to the last 24 months which will determine what interest rate they offer. If you have had credit issues in the past but now have a 600+ score it is a good idea to talk to a Sunlite Mortgage broker to have them asses your chances of getting the mortgage you want.

Potential borrowers with a prior history or current bankruptcy or have had collection issues, judgments or other derogatory public records may be considered risky. The presence of these events may have a significant negative impact on a credit score, and you will either be declined or offered higher mortgage rates. Talk to a Sunlite Mortgage broker for assistance on which mortgage lenders will accept you with these prior cred issues.

inquiries require the consent of the individual, and some may affect the individual’s credit score calculation. The only inquiries which may impact a credit score are those related to active credit seeking (such as applying for a new loan or credit card) which are called “hard hits.”

The hard inquiry may be the leading indicator, the first sign of financial distress that appears on the credit file. Not every inquiry is a sign of financial difficulty, and only a number of recent inquiries, in combination with other warning signals on the credit file should lead to a significant decline in a credit score.

Your credit score does not consider requests a creditor has made for your credit file or credit score in order to make a pre-approved credit offer, or to review your account with them, nor does it take into account your own request for a copy of your credit history. These are some examples of “soft inquiries” or “soft pulls” of your credit.

Someone looking for a single mortgage and has two to three mortgage companies access their credit file within a given timeframe will have those credit pulls considered as one their score will be marginally affect your score, if at all.

There’s more than one credit scoring model available and more than one range of scores. However, most credit score ranges are like the following:

800 to 850 Excellent — In this range you will be offered the lowest interest rates and best terms on: mortgages, loans, and lines of credit. You have a long history of using credit responsibly, a mix of different types of credit, consistently paying on time, and keeping your account balances low.

740 to 799: Very Good — Individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit.

670 to 739: Good — Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers.

580 to 669: Fair — Individuals in this category are often considered “subprime” borrowers. Lenders may consider them higher-risk, and they may have trouble qualifying for new credit.

300 to 579: Poor — Individuals in this range often have difficulty being approved for new credit. If you find yourself in the poor category, it’s likely you’ll need to take steps to improve your credit scores before you can secure any new credit.

If you’ve never opened any kind of credit account, or if all your accounts are closed or inactive and have fallen off your report after several years. If you have little or no credit history, getting approved can be difficult because lenders have no way to measure your level of credit risk.

Different lenders have different credit score or credit history requirements as a prerequisite for a mortgage loans. Many applicants don’t know what these requirements are, so they miss out on getting a great mortgage. Having a Sunlite Mortgage broker who is familiar with the mortgage landscape and have access to many different lenders could be the difference in getting a good mortgage and a bad mortgage or no mortgage at all.

There’s no “magic number” that guarantees you’ll be approved for a loan or receive better interest rates and terms. However, in many popular scoring models, borrowers need a minimum score of 670 for their credit to be considered “good.”

Overall, the higher your credit score is, the more likely you are to appeal to lenders. Higher credit scores indicate that a borrower has demonstrated responsible credit behavior in the past. So, they also often receive more favorable terms and interest rates from lenders.

Your credit score is calculated using the information found on your credit report. Your payment history, the mix of credit accounts you have, the length of your credit history and your credit utilization rate (the percentage of available credit limits you are using) are all factors that might influence your credit scores.

However, there’s more than one way to calculate your credit scores. Lenders and credit reporting agencies often use different scoring models. One model might place the most importance on your payment history. Another could prioritize the types of credit you have available. Because of these differences, your score could vary depending on how it was calculated.

Your scores may also vary based on the credit reporting agency providing them. This is because not all lenders and creditors report information to all three nationwide consumer reporting agencies (Equifax and TransUnion). Some may report to only both, one or none at all.

The good news is your credit score is not a fixed number. With time and responsible choices, it can be improved. Just keep in mind that this process takes patience. This is especially true if you haven’t kept the best credit habits in the past.

Some credit habits that could improve your score in the long term include making your payments on time, keeping old accounts open to lengthen your credit history and keeping your credit utilization rate low.

You’ll also want to make sure to keep tabs on your credit report to confirm that the information included is up to date. Credit reports do not include your credit scores, but here are a few ways you can check your credit scores.

Our Sunlite Mortgage agents will walk you through the choices available and provide you with the advice to help you identify the most suitable mortgage product based your current situation. If this isn’t currently possible, we will be happy to go over your credit with you to help find ways to improve your financial health and create a plan and a timeline for you to be qualified for a mortgage. Call us today at (877) 385-6267 or request a meeting so we can start your home ownership journey.