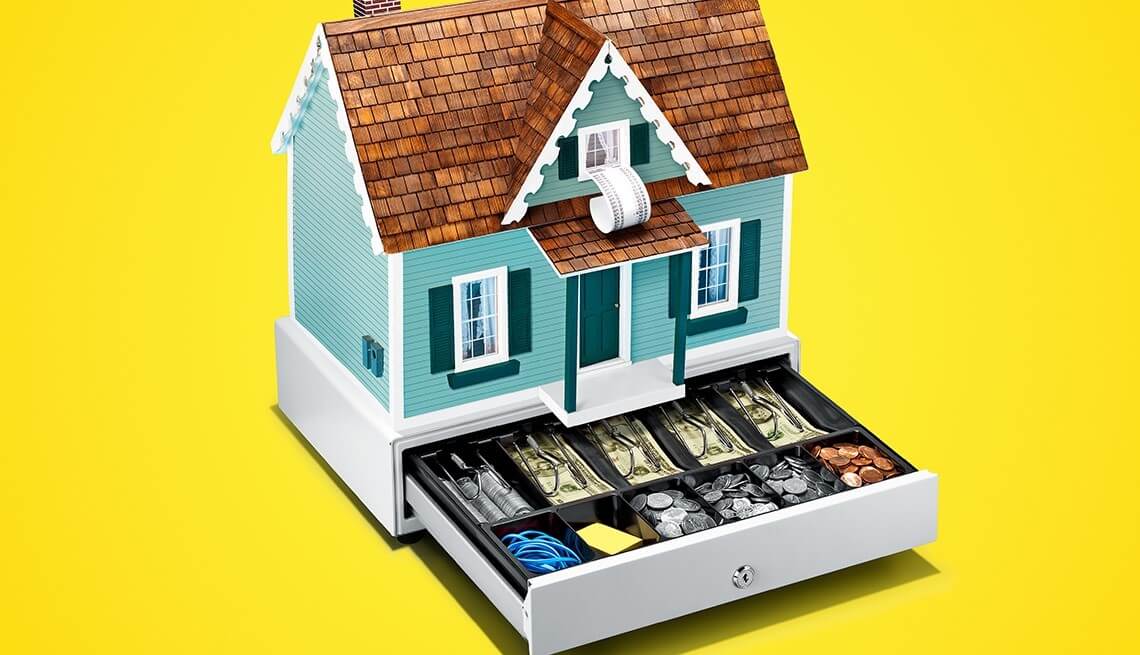

Home equity loans are a popular form of borrowing in today’s housing market. They are a type of loan that allows a homeowner to borrow money by using the equity in their home as collateral. The loan is secured by a lien on the borrower’s home.

The amount of money that a homeowner can borrow is based on the equity in their home. Equity is determined by subtracting the amount owed on the home from the current market value of the home. Equity is the difference between the current market value and the amount owed on the loan. Homeowners can use the equity in their homes to get a loan for any purpose, including home improvement projects, debt consolidation, or any other purpose.

Home equity loans are generally easier to qualify for than other types of loans. This is because the loan is secured by the equity in the home. This means that if the borrower fails to repay the loan, the lender can foreclose and take the home as payment. Therefore, the lender is more likely to approve the loan because they have the security of the home as collateral.

Home equity loans can offer borrowers some advantages over other types of loans. First, the interest rate on home equity loans can be lower than other types of loans because of the security provided by the equity in the home. Second, the interest on the loan may be tax deductible, so borrowers can save money on their taxes by deducting the interest paid. Finally, the loan terms and repayment options are usually more flexible than other types of loans.

Before taking out a home equity loan, it is important to carefully consider the pros and cons of the loan. Home equity loans can be a great way to access the funds needed for a variety of purposes, but it is important to remember that the loan is secured by the equity in the home. This means that if the borrower fails to repay the loan, the lender can foreclose on the home and take possession of it. Therefore, it is important to make sure that the loan amount is affordable and that the borrower can make the payments on time. Additionally, it is important to shop around for the best interest rate and terms.

We are here to help you. Give us a call today.