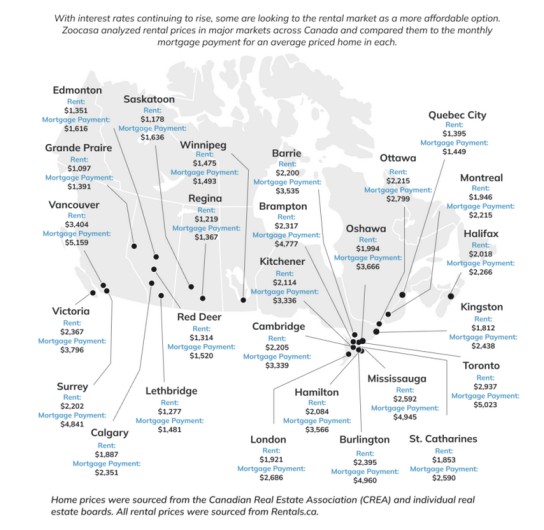

A recent study by Zoocasa reveals that the cost of renting versus buying comparable housing in select Canadian markets is equal. The difference between renting and buying was less than $500 per month in eleven different markets. However, the report notes that no need is more affordable to buy in than rent, with the most affordable options found outside of Ontario and British Columbia. For example, in Winnipeg, the average monthly rent was $1,475, while the average mortgage payment was $1,493, with a difference of just $18. Quebec City and Regina also showed slightly more affordable rents, differing by $54 and $148, respectively, per month. It is essential to consider other costs, such as utilities, maintenance, and property taxes, which must be factored into the study.

On the other hand, in some markets, the monthly cost between renting and owning was more substantial. The most significant payment difference was found in Surrey, B.C., with the average mortgage payment calculated at $2,639 more than the cost of renting. Similar significant gaps were seen in the Ontario cities of Burlington and Brampton.

The study’s findings contrast with a 2021 Royal LePage survey that showed, on average, homeownership cost less than renting a comparable housing unit, attributed to record-low interest rates at that time.

The data for average rental rates was sourced from Rentals.ca. At the same time, mortgage payments were based on average house price data from the Canadian Real Estate Association, assuming a 20% down payment and a 5.04% interest rate amortized over 30 years.